It’s tax time again and its down to H&R Block or TurboTax just like it is every year, or is it?

When it comes to tax time, some decisions are easy, others are quite difficult. Having a business degree and years of great coaching by a tax attorney I learned a few things. First and foremost, if you don’t tell the IRS about money you made, like say trading crypto, that can get you tossed in jail. If you try to deduct that private jet you rented to avoid taking your shoes off for the TSA, you’ll just get a letter saying sorry but no and a bill for the difference you owe in taxes.

For nearly 25 years I have used TurboTax religiously. Being a Mac user it has always been infuriating that there isn’t a good mac version. As a member of a “multi member llc”, I have no choice but to use a PC version of software. TurboTax business was the only solution that wasn’t “online”. Most tax programs now are online. I get it, easy distribution, fix one server, everyone is fixed blah blah blah. The problem I have is the EULA. It says that they can use your data. For what I wonder. For that reason alone I stick to the desktop versions. You can choose Block or TurboTax for online or desktop versions.

The Parallels Universe

For the last five years I ran Parallels on my mac and had the PC version of Quickbooks® and TurboTax® running on it. It was the only reason I used Parallels. I also need a PC to run my home security system, and with big Sur and Parallels. All of it worked until I upgraded to a 2020 Mac with the M1 chip and Big Sur. A new Parallels subscription for the year was $70 on Amazon. I would then also need a copy of Windows 10.

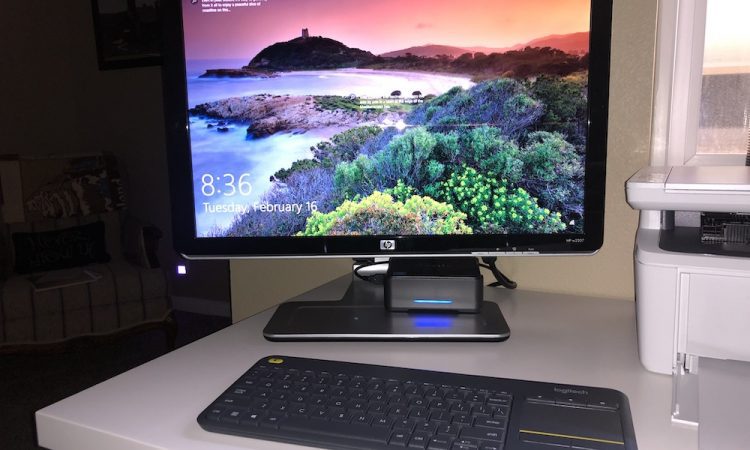

Nothing I found said the USB port would work with Windows 10 on parallels, so instead I bought a micro PC just to do my books. With an old monitor and keyboard laying around, I figured why not. For the price of Windows 10 Home and Parallels, I got a PC with Windows 10 Pro included.

The little micro pc needs to do my bookkeeping, taxes and connect to my alarm, nothing else, so I didn’t need much. The PC was so small it fit on the monitor stand.

Changing Gears Or At Least Trying

Last year I used TurboTax for my business filing, and TurboTax Premier for my personal tax filing. I found they were cheaper from Costco and Amazon so I bought them there. This year I was so fed up with Quickbooks upgrade fees and intuit in general for not making a better mac product, that I wanted to try something different. The last two years, TurboTax was about 90% ready for mainstream. Maybe the Trump rules goofed them up, but that is no excuse. The errors drove me nuts in the program, I had to manually enter several items.

This year I gave H&R Block Tax Premium home a business a try. The website is like intuits, very vague and makes it look easy. It is not for technical buyers like me. After a lot of digging a found a place where it could do the form 1065. This is the form I need to file for my multi member LLC business. It turned out that it didn’t work, I still needed TurboTax Business for that.

The H&R Block Systems Message Forbidden

Since I already bought the PC, downloaded the H&R block software I figured I would keep going. And since I needed to get TurboTax business, I still could have one thing that intuit didn’t hold over my head. Unfortunately it was not longer H&R Block or TurboTax, instead it was Block and TurboTax.

This year TurboTax business was smooth and easy, but we also simplified our business. It imported the data correctly from Quickbooks. And that was the mac version by the way. The big complaint I have is that they ask you to fill out two long forms of information before importing the same information from the previous years taxes.

With the business taxes complete, the K-1’s emailed to our partners and investors, it was time to do the personal taxes. The H&R Block software was over simplified, so I gave up on the interviewer and just jumped to the forms. Lets face it, personal taxes aren’t that hard these days. Gather your W-2’s and 1099’s and put in the numbers. They close your eyes and hope for a refund not a bill. Ok it isn’t that easy, but it doesn’t require the millions of questions that make no sense either.

I decided to give H&R block some feedback about the interview process. TurboTax does it a little better in simpler terms, which for non-MBA’s is probably easier to understand and get your taxes done. I licked the little “feedback” button at the bottom, filled out the form and got a box that ended with:

System Message Forbidden

Say what? My feedback is “Forbidden”? Really?

The One Person in Tech Support

Suddenly I had a flashback to a couple years ago where I sat on hold with tech support for Turbo Tax. That call lasted nearly four hours. I was feeling better about H&R Block already. While dialing the 800 number, I clicked on the chat box and started surfing the help files and the internet. Why was I forbidden from sending feedback? I was number 71 in the chat que with 50 minutes to go in the phone que. Suddenly I was 72 in the chat que and had 60 minutes or longer in the phone que. They won, I gave up.

I left the phone and chat open while I finished by taxes. Confident I was close enough it was time to start the review and file. The review said I was only allowed two form 2106. I have never heard of this. Being actors, my wife and I both have union dues and agency fees that are quite substantial. I also have expenses related to the business that my parters won’t let me take out of the business. Then I read the 2106 and it was only for certain types of jobs. Two of the three form 2106 were removed and I tried to find a place to deduct my union dues. After 20 minutes of finding nothing, I decided it was time for a break. Still number 40 in the chat que and 50 minutes to go in the phone que, I hung up and walked away.

The Final Answer

When I came back to finish my taxes, I found a place to enter other deductions and put in the amount of union dues. It would save me about $80 in taxes. I didn’t think that was worth the hassle to start over and buy TurboTax so I hit “file”. It happened again. System Message Forbidden.

Once again I was in the que. Block or TurboTax doesn’t matter, the hold que is long. That said, here is my big critique to every software company out there. Every single error box should have a corresponding help file. The keywords system message and forbidden should be in your help index. This was not true at TurboTax last year and not true at Block this year. While sitting number 44 in the chat que with an hour or more to go on hold I started digging again.

System Message Forbidden – The Fix!

It turns out the H&R Block software has a few bugs in how they keep your data secure. The SSL can even prevent you from getting updates depending on how your system is configured. Using Frontier FiOS it turns out is an issue. FiOS doesn’t trust H&R Block. That wasn’t my issue though. The proxy server was.

To solve the problem it took three steps.

1. Turn off windows firewall for the public network (scary isn’t it)

2. Go to tools>settings>proxy server and select the top button to bypass the proxy server

3. save and restart the tax program.

After doing this, I was able to restart the software, enter my credit card number and then file federal and state taxes. Immediately after I turned the windows firewall back on. I was still number 31 in the chat que so I decided to write this while I wait. As I finish I am still number 20. H&R Block, if you are reading this, here is my feedback, sadly I think it will be back to TurboTax next year, which probably means Quickbooks too.

Now that the taxes are filed, I can get back to work. Anyone want to put LED’s in some old cars?